Steps towards the decarbonization goal

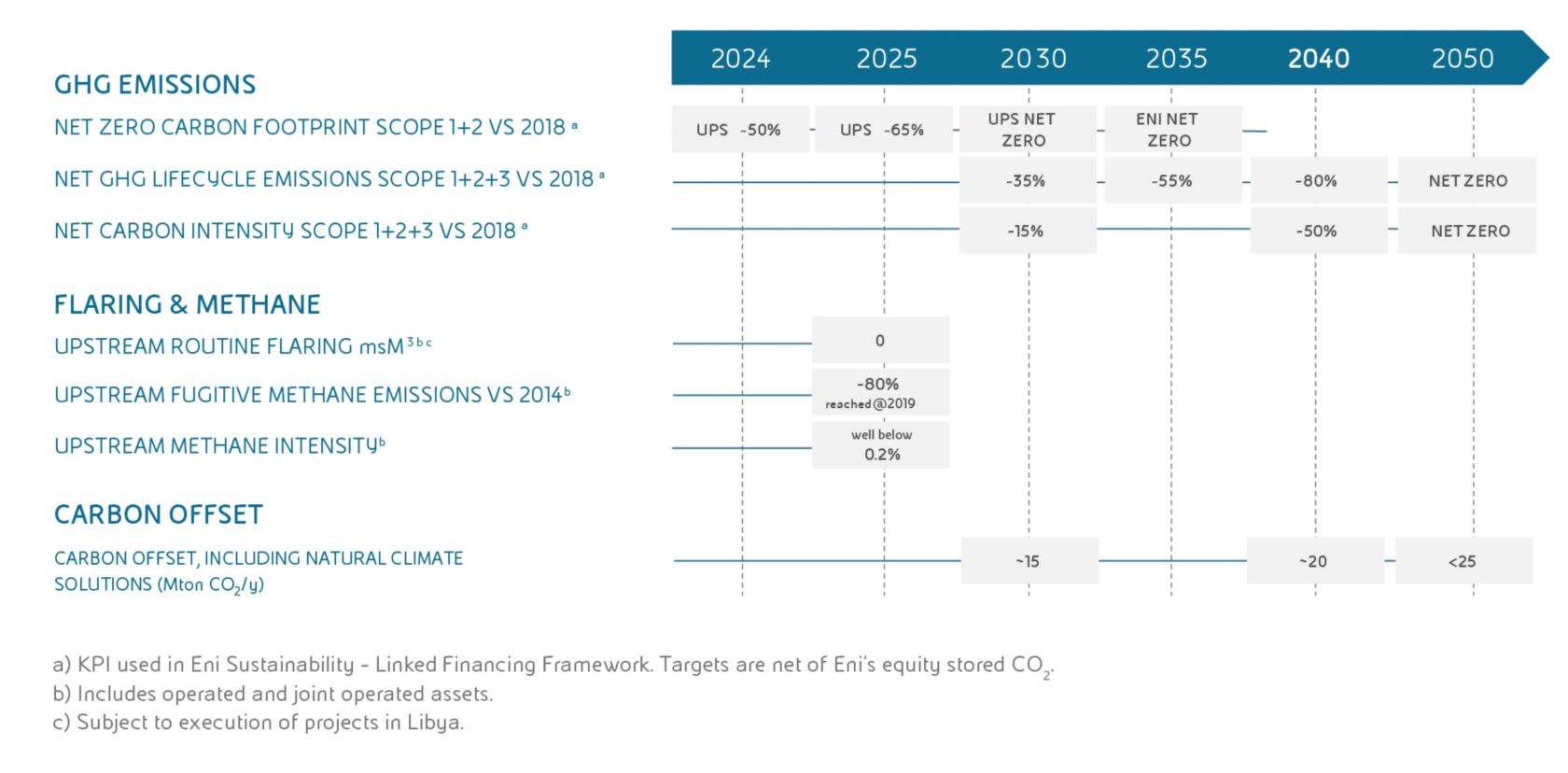

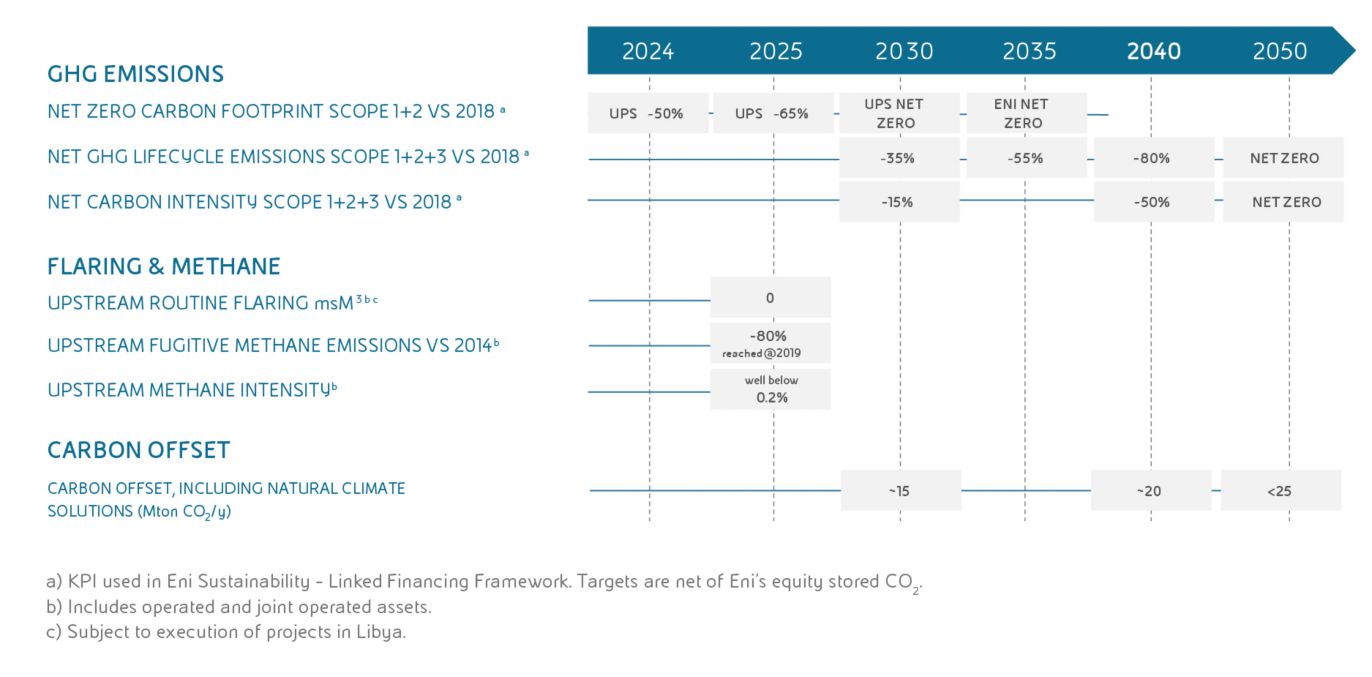

We have initiated an industrial transformation involving all business lines to decarbonize the entire company. To this end, we invest in researching, developing, and implementing transition technologies. Our approach aims to help solve what the World Energy Council refers to as the energy trilemma by simultaneously striving to ensure environmental sustainability, supply security, and energy affordability. While aiming for carbon neutrality by 2050, our decarbonization strategy defines medium- to long-term emission targets and business objectives. The process consists of a series of intermediate targets that first envisage zero net emissions (Scope 1+2) from the upstream business by 2030 and from all other business lines by 2035, then zero net emissions, including all GHG Scope 1, 2, and 3 emissions both in absolute terms and in terms of intensity, by 2050. Our growth and transformation plans involve the entire value chain. We align all our plans and investments to our strategy to achieve a fully decarbonized product portfolio.

Target of carbon neutrality by 2050

SCOPE 1

Direct emissions, attributable to Eni’s production facilities.

SCOPE 2

Indirect emissions from power, heat, and steam generation, purchased from other energy companies and consumed by Eni’s production facilities.

SCOPE 3

Indirect emissions produced throughout Eni’s product value chain, upstream and downstream of the company’s operations (e.g. suppliers and clients).

The strategy to achieve Net Zero

We envisage optimizing and improving the Oil & Gas portfolio through progressive emission reductions, growth of renewable energy, a circular economy, and new energy solutions and services. Our plan is supported by cross-cutting activities that seek to leverage existing solutions and develop breakthrough innovations to accelerate the process.

Summary of main decarbonizations target

Business levers

How we will achieve carbon neutrality

Eni's strategy towards Net Zero is a collaborative effort involving several actions. On the one hand, it focuses on decarbonizing our own operations (reducing Scope 1+2 emissions). On the other hand, it accelerates the decarbonization of the value chain, with a particular emphasis on consumers through the supply of low- and zero-carbon products (reducing Scope 3 emissions).

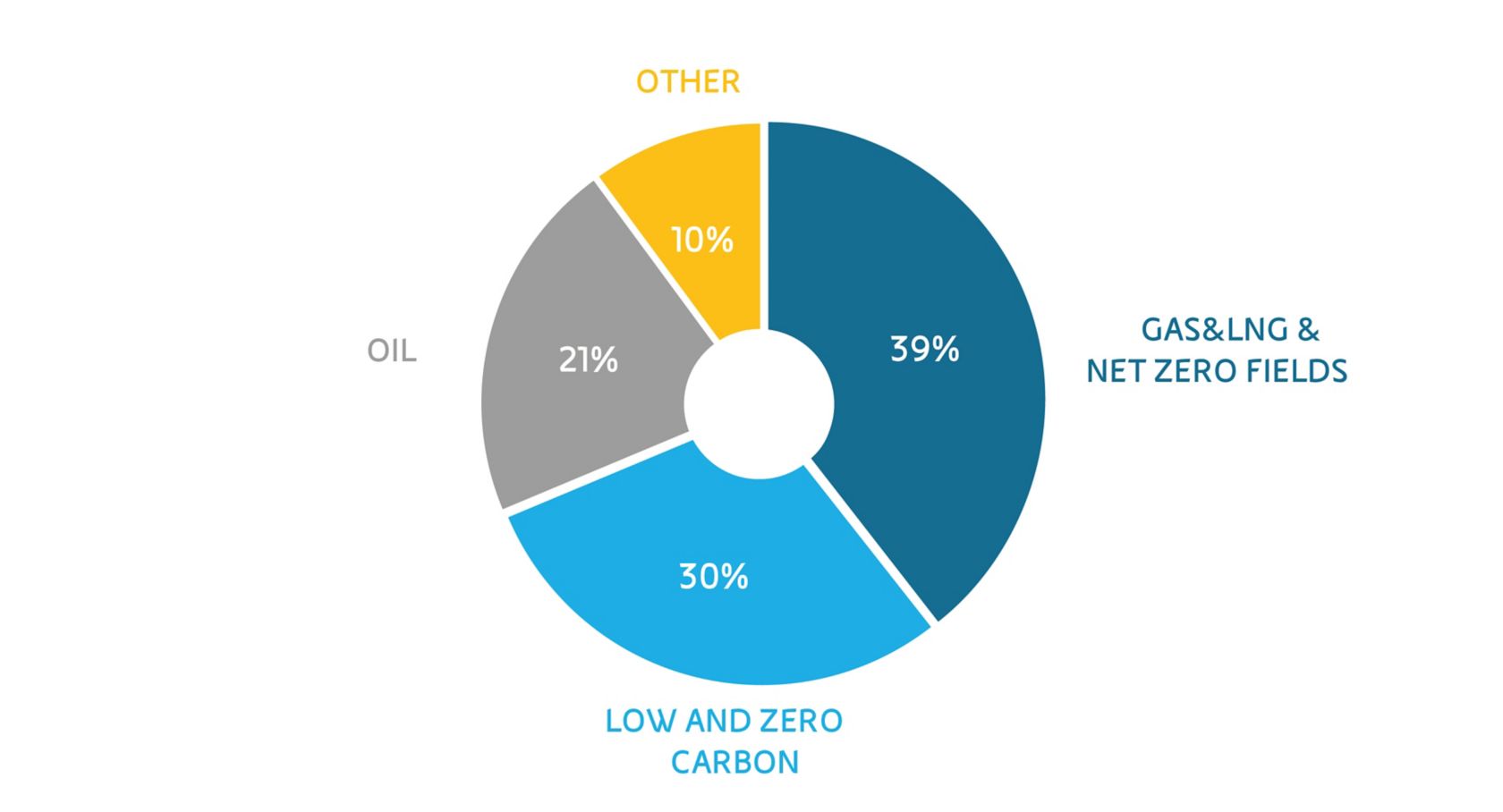

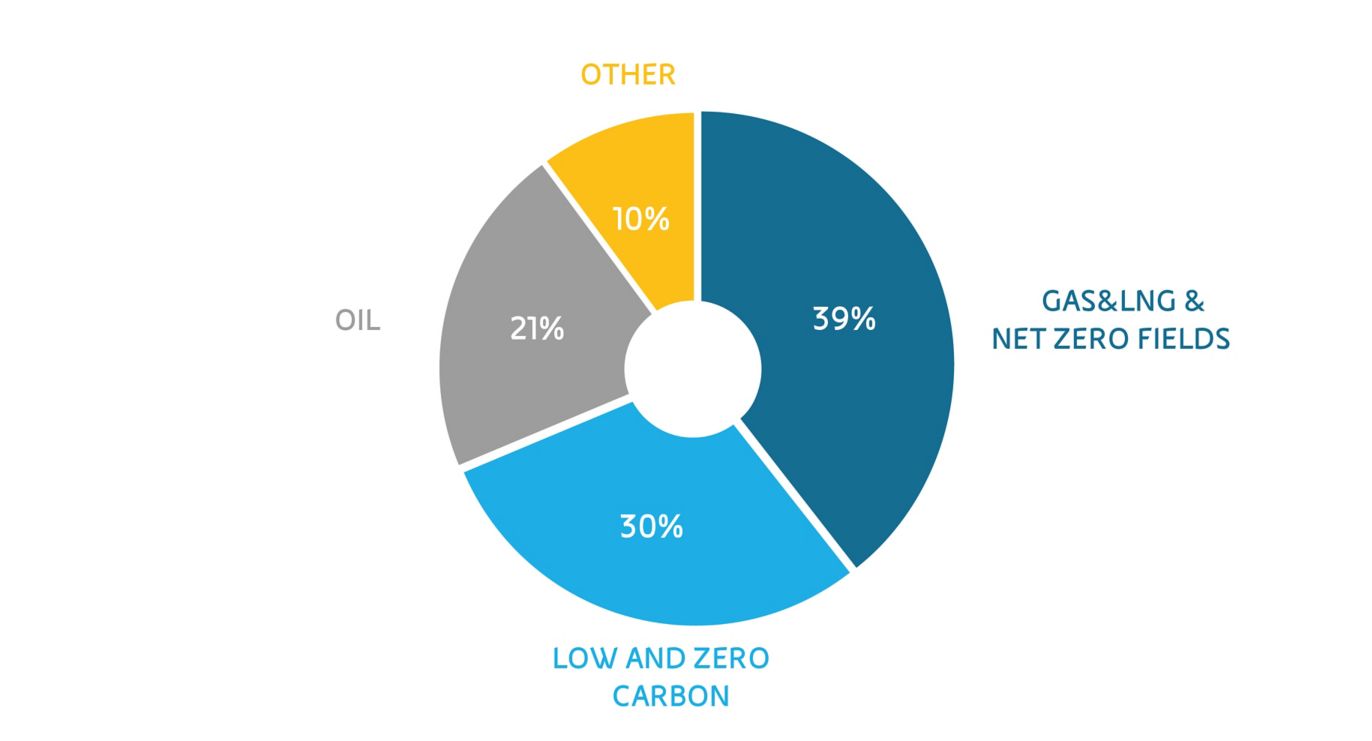

The achievement of the Net Zero target to 2050 for all Scope 1+2+3 emissions is supported by an approach involving the entire value chain. This approach envisions optimizing our upstream portfolio through progressive decarbonization, combined with the growth of bio, renewable, and circular economy businesses. We are also focusing on new energy solutions and services. For upstream, hydrocarbon production will target a progressive increase in the gas component (including condensates, from 2024), reaching more than 60% by 2030 and more than 90% after 2040. The increased gas component will also impact will also impact the midstream gas portfolio (transportation and marketing), which will see an increasing integration with equity projects. The development of biofuels will contribute to the decarbonization of transportation and provide an opportunity to convert the current conventional refining capacity. CO2 capture, storage, and utilization (CCUS) projects will have a complementary function in reducing the hard-to-abate residual emissions with existing technologies. Finally, compensation of residual emissions through offsets, mainly from Natural Climate Solutions, will be used to achieve net zero by 2050. The speed of the evolution of this transformation and the relative contribution of businesses will depend on several variables, including market trends, the scientific-technological scenario, and relevant regulations.

Investment in low- and zero-carbon activities

We anticipate investments dedicated to low- and zero-carbon activities to reach 30% of total investments in 2024-2027.

Risks and opportunities related to climate change

The risk and opportunity management process related to climate change is part of the Integrated Risk Management Model (IRM) that we developed to support the management’s decision-making process by strengthening awareness of the risk profile and related mitigation actions. In parallel, we strive to ensure our operations’ integrity and to responsibly manage socio-economic and environmental impacts in the countries where we are present. Climate change risks are analyzed, assessed, and managed by taking into account the TCFD (Task Force on Climate-related Financial Disclosure) recommendations that refer to both energy transition risks (market scenario, regulatory, legal and technological evolution, and reputational aspects) and physical risks (acute and chronic), through an integrated and cross-cutting approach involving all relevant functions and business lines (NFS).

Towards carbon neutrality

Net Zero: our path to decarbonization

We aim to achieve carbon neutrality by 2050 through a plan with progressive targets involving all sectors.