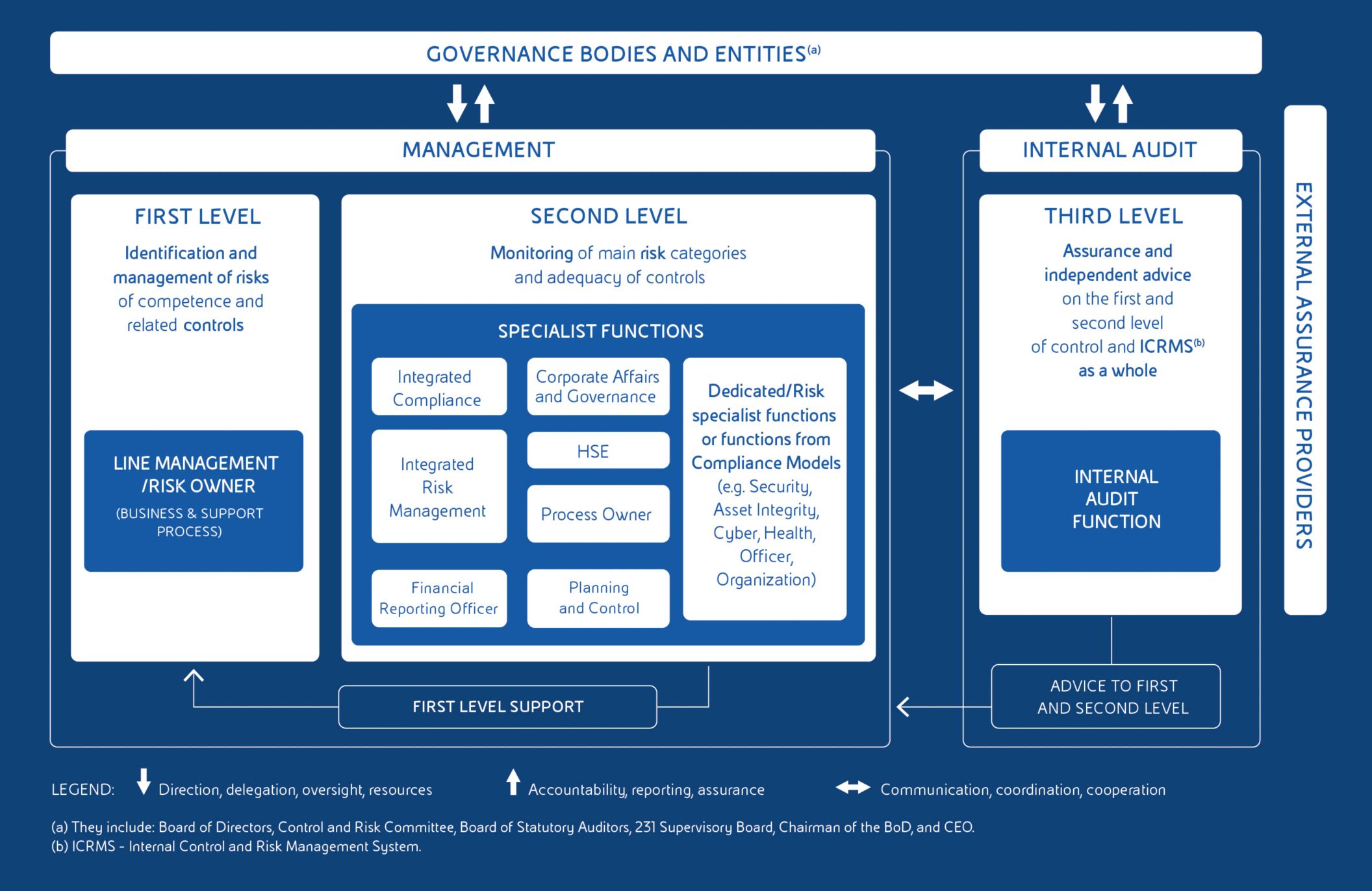

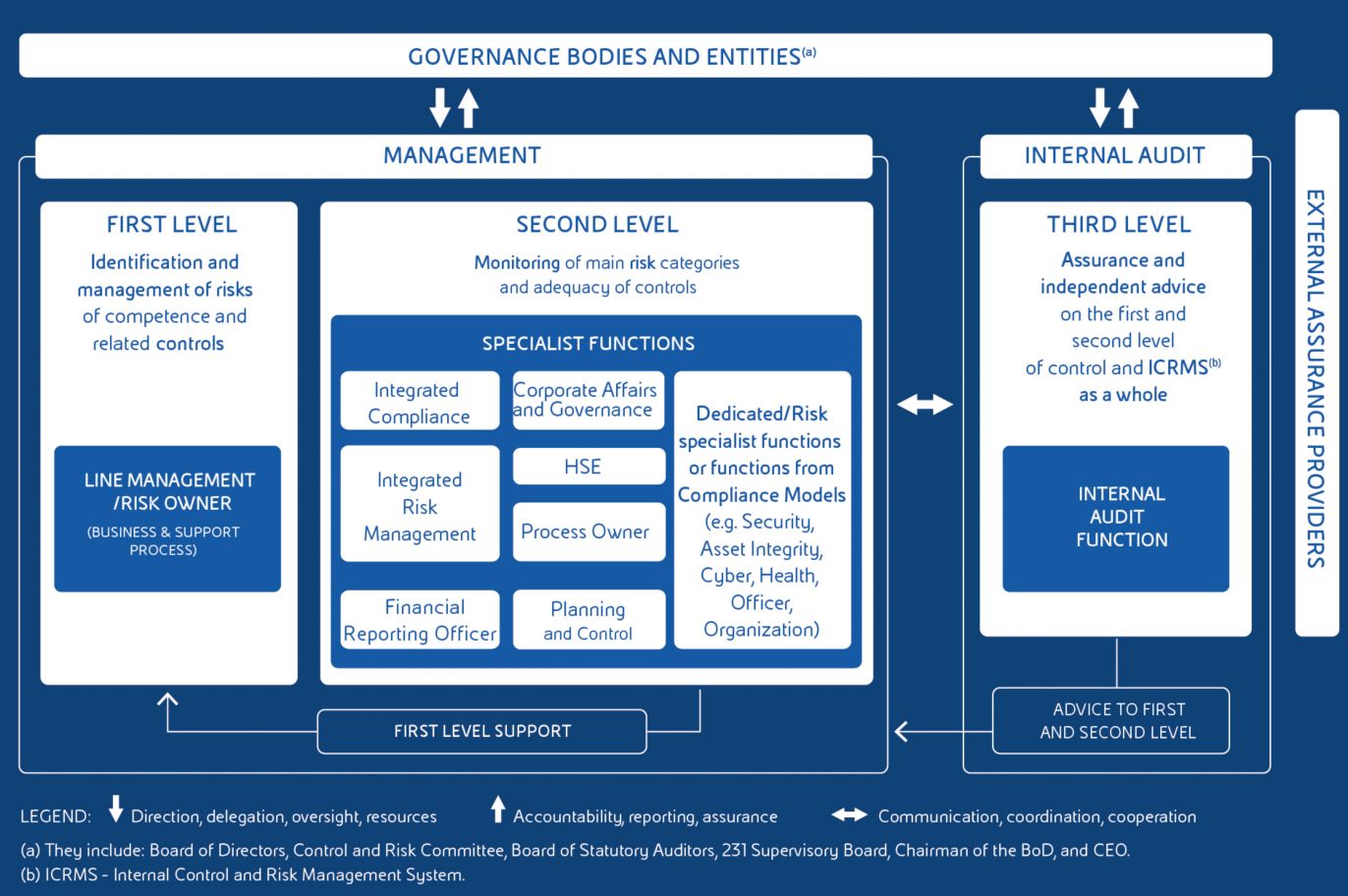

A model that aims to strengthen company awareness

Eni developed and adopted an Integrated Risk Management Model (IRM Model) supporting Eni’s management awareness in taking informed decisions (risk-informed) through the evaluation and assessment of risks in the short, medium and long term, within the framework of an organic, comprehensive and perspective vision.

The IRM Model is based on a system of methodologies and skills that leverages on criteria ensuring consistency of the evaluations (data quality, objectivity of the detection and quantification of the mitigation actions) to improve the effectiveness of the analyses, adequacy of support for the main decision-making processes (definition of the Strategic Plan) and guarantee the disclosure to the administration and control structures.

Risk Governance and guidelines for Risk management

Risk Governance attributes a central role to the Board of Directors (BoD) which defines the nature and level of risk in line with strategic targets, including in evaluation process all the elements that can be relevant in a view of the Company’s sustainable success. The BoD, with the support of the Control and Risk Committee, outlines the guidelines for risk management, so as to ensure that the main corporate risks are properly identified and adequately assessed, managed and monitored, determining the degree of compatibility with company management consistent with the strategic targets.

The Integrated Risk Management model (IRM)

Eni’s CEO, through the IRM process, presents every three months a review of the Eni’s main risks to the Board of Directors. The analysis is based on the scope of the work and risks specific of each business area and processes aiming at defining an Integrated Risk Management policy; the CEO also ensures the evolution of the IRM process consistently with business dynamics and the regulatory environment. Furthermore, the Risk Committee, chaired by the CEO, holds the role of consulting body for the latter with regards to major risks. For this purpose, the Risk Committee evaluates and expresses opinions, at the instance of CEO, related to the main results of the IRM process.

The Integrated Risk Management process (IRM)

The IRM process ensures the detection, consolidation and analysis of all Eni’s risks and supports the BoD to verify the compatibility of the risk profile with the strategic targets, also in a medium/long-term approach. The IRM supports management in the decision-making process by strengthening awareness of the risk profile and the associated mitigations. The process, regulated by the “Management System Guideline (MSG) Integrated Risk Management” is continuous, dynamic and includes the following sub-processes: (i) Risk governance, methodologies and tools (ii) Risk Strategy, (iii) Integrated Risk Management, (iv) Risk knowledge, training and communication.

The “Integrated Risk Management” sub-process

The “Integrated Risk Management” sub-process includes: periodic risk assessment and monitoring cycles in order to understand the risks taken on the basis of the strategic targets of the four year strategic plan also looking at the medium-long term, through the definition, evaluation and monitoring of the main company’s risks and the related treatment measures; contract risk management and analysis aimed at the best allocation of the contractual responsibilities with the supplier and their adequate management in the operational phase; integrated analysis of existing risks in the Countries of presence or potential interest (ICR) which represents a reference for risk strategy, risk assessment and project risk analysis activities; support to the decision-making process for the authorization of investment projects and main transactions (Integrated Project Risk Management and M&A). The risks are assessed with quantitative and qualitative tools considering both the likelihood of occurrence and the impacts that would occur in a defined time horizon when the risk occurs.

The risk knowledge, training and communication sub-process is aimed at increasing the diffusion of the culture of risk, at strengthening a common language among the resources that operate in the risk management area across the different Eni businesses as well as sharing information and experiences, also through the development of a community of practice. Eni’s top risks portfolio consists of 19 risks classified in: (i) external risks, (ii) strategic risks and, finally, (iii) operational risks.